Track Business Expenses for

Canadian Tax Season

CRA-compliant reports • GST/HST auto-extracted • T2125 line references • Current CRA mileage rates

ExpenseBot finds receipts in Gmail, reconciles credit cards, and generates T2125-ready year-end reports automatically. Built in Toronto for Canadian freelancers, contractors, and small businesses.

Join 5,000+ Canadians tracking expenses on autopilot

60-day free trial • No credit card • Your data stays in your Google Drive

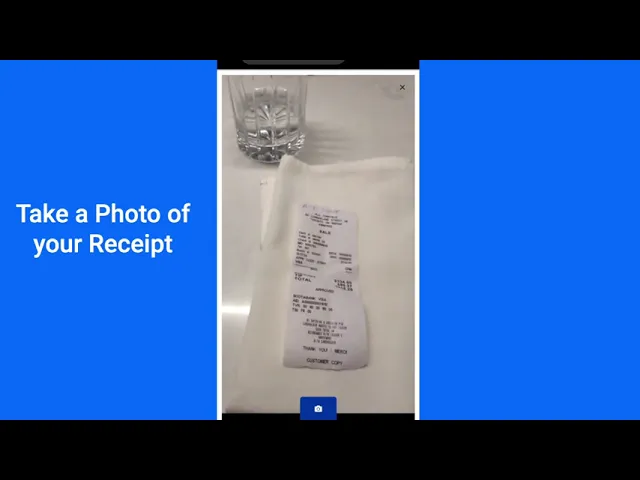

Watch: 30 seconds from receipt to CRA-ready spreadsheet

The Canadian Freelancer's Tax Season Nightmare

Before ExpenseBot: The Shoebox Method

- Jan-Dec: Stuff receipts in a folder (or shoebox).

- January: Panic. Spend a weekend sorting a year's worth of paper.

- February: Try to figure out which T2125 line each expense goes on.

- March: Realize you missed hundreds in GST/HST ITCs from lost receipts.

- April 30: File taxes, hoping the CRA doesn't ask questions.

After ExpenseBot: The 5-Minute Method

Jan-Dec: Snap photos of receipts as you go. Let the AI handle the rest.

Jan 1st: Receive your complete T2125-ready report with every deduction categorized, GST/HST totals calculated, and CRA line references included. Forward to your accountant. Done.

Canadian Tax Deductions You're Probably Missing

ExpenseBot automatically categorizes these to the correct T2125 lines

Home Office (T2200/T2200S)

Rent, utilities, internet, property tax — claim the percentage of your home used for business. ExpenseBot calculates the split automatically.

T2125 Lines 8810–8860

Vehicle & Mileage (CRA Rates)

70¢/km for first 5,000 km, 64¢/km after (2025). Import client visits from Google Calendar — distance calculated automatically via Google Maps.

T2125 Line 9281

Meals & Entertainment (50%)

Business meals are 50% deductible. ExpenseBot applies the 50% rule automatically and extracts the GST/HST from each receipt.

T2125 Line 8523

Phone & Internet

Deduct the business-use percentage of your phone and internet bills. ExpenseBot tracks these recurring expenses month over month.

T2125 Line 8220

Professional Development

Courses, conferences, books, subscriptions — 100% deductible when related to your business. ExpenseBot catches these from Gmail automatically.

T2125 Line 8860

Accounting & Legal Fees

Your accountant's fees, legal advice, and bookkeeping costs are 100% deductible. Even the cost of ExpenseBot itself is deductible.

T2125 Line 8862

Deduction guidance only — confirm with your tax professional. T2125 line references based on CRA 2025 form.

ExpenseBot vs. Spreadsheets for Canadian Tax

Ready to Simplify Canadian Tax Season?

60-day free trial. No credit card. Set it up in 30 seconds and let ExpenseBot handle the CRA paperwork.

Start Free Trial →Works with any Gmail account • Your data stays in your Google Drive

What Canadian Freelancers Get

T2125-Ready Year-End Report

Complete spreadsheet with every deductible expense mapped to T2125 line items. GST/HST totals calculated. Hand it to your accountant or use it to file yourself.

CRA Mileage at Current Rates

Import client visits from Google Calendar. Distance calculated via Google Maps. CRA rates applied automatically — 70¢/km first 5,000 km, 64¢ after. No GPS app needed.

Learn more about Mileage Tracking →GST/HST Auto-Extracted

AI reads every receipt and pulls out GST, HST, PST, and QST amounts automatically. Your year-end report shows total ITCs ready for your GST/HST return.

CRA Audit-Ready Documentation

Every expense linked to its original receipt image in YOUR Google Drive. If the CRA asks for proof, you have it instantly — organized and searchable.

Accountant-Friendly (Free for Them)

Clean spreadsheet with GL summary, all receipts attached, one-click export to QuickBooks, Sage 50, Xero. ExpenseBot is FREE for accountants forever.

Any Canadian Bank or Card

Upload statements from RBC, TD, Scotiabank, BMO, CIBC, Desjardins — any bank. AI matches transactions to receipts and flags missing ones.

Turn On Automation = Zero Work Until Tax Time

📧 Gmail Auto-Scan (Turn ON)

ExpenseBot scans your Gmail overnight. Finds every receipt from Amazon.ca, Uber, software subscriptions, everything. No forwarding rules. No manual searching.

💳 Monthly Credit Card Check (Turn ON)

First of each month: "You have 47 transactions, 43 matched to receipts. Click here to add the missing 4." Never miss a deduction — or an ITC.

📊 Quarterly Reports to Accountant (Turn ON)

Every quarter, ExpenseBot emails your accountant a clean spreadsheet with all expenses, GST/HST totals, and receipts. They stay updated, you stay hands-off.

🎯 Year-End CRA Package (Turn ON)

December 31: Get your complete T2125-ready report. Every expense mapped to CRA lines, every deduction calculated, GST/HST ITCs totalled, every receipt attached.

🚗 Mileage from Calendar (Turn ON)

Client meetings in Google Calendar with addresses? Import them directly. Distance calculated via Google Maps at CRA rates. No GPS app, no battery drain.

Or do it manually — snap photos, forward emails, upload PDFs anytime. Your choice.

"I used to dread CRA season — digging through emails for receipts, manually calculating GST credits, spending days on my T2125. Now ExpenseBot scans my Gmail automatically, extracts the HST from every receipt, and my year-end report maps everything to T2125 lines. My accountant in Toronto said it's the cleanest self-employed return she's ever seen. Tax prep went from 3 days to 30 minutes."

— Freelance Consultant, Toronto

Frequently Asked Questions

Is ExpenseBot CRA-compliant?

Yes. ExpenseBot generates reports aligned with CRA requirements, including T2125 Statement of Business Activities categories. Every expense is linked to its receipt image in your Google Drive, providing audit-ready documentation if the CRA requests proof of deductions.

Does it track GST/HST automatically?

Yes. ExpenseBot's AI automatically extracts GST, HST, PST, and QST amounts from your receipts. Your year-end report includes total tax paid by category, making it easy to claim Input Tax Credits (ITCs) on your GST/HST return.

Does it use the current CRA mileage rate?

Yes. ExpenseBot uses the current CRA automobile allowance rates — 70¢/km for the first 5,000 kilometres and 64¢/km after that (2025 rates). Rates are updated each tax year when CRA publishes them.

Can my Canadian accountant access the data?

Yes — and it's FREE for accountants forever. Share your expense reports with one click. Your accountant gets organized spreadsheets with every receipt attached, GL summaries, and T2125-ready categorization.

Does it help with the T2125 form?

Yes. ExpenseBot's year-end report maps your expenses to T2125 line items automatically — advertising (line 8521), meals and entertainment at 50% (line 8523), office expenses (line 8810), professional fees (line 8860), and more.

Does it work for incorporated businesses in Canada?

Yes. ExpenseBot works for sole proprietors (T2125), partnerships, and incorporated businesses. For corporations, expenses are categorized for your corporate tax return. The accountant-friendly format exports to QuickBooks, Sage 50, Xero, and other Canadian accounting packages.

Start Now, Thank Yourself at Tax Time

Every day you wait is more receipts to hunt down later. Turn on automation today and never think about expense tracking again.

Built in Toronto for Canadian businesses

Use code SAVE50 for 50% off your first year!

✓ No credit card required • ✓ 60-day free trial • ✓ Cancel anytime

✓ Your data in your Google Drive — we never store it

Freelancer Details | Mileage Tracking | Sage 50 Canada | For Accountants (Free)